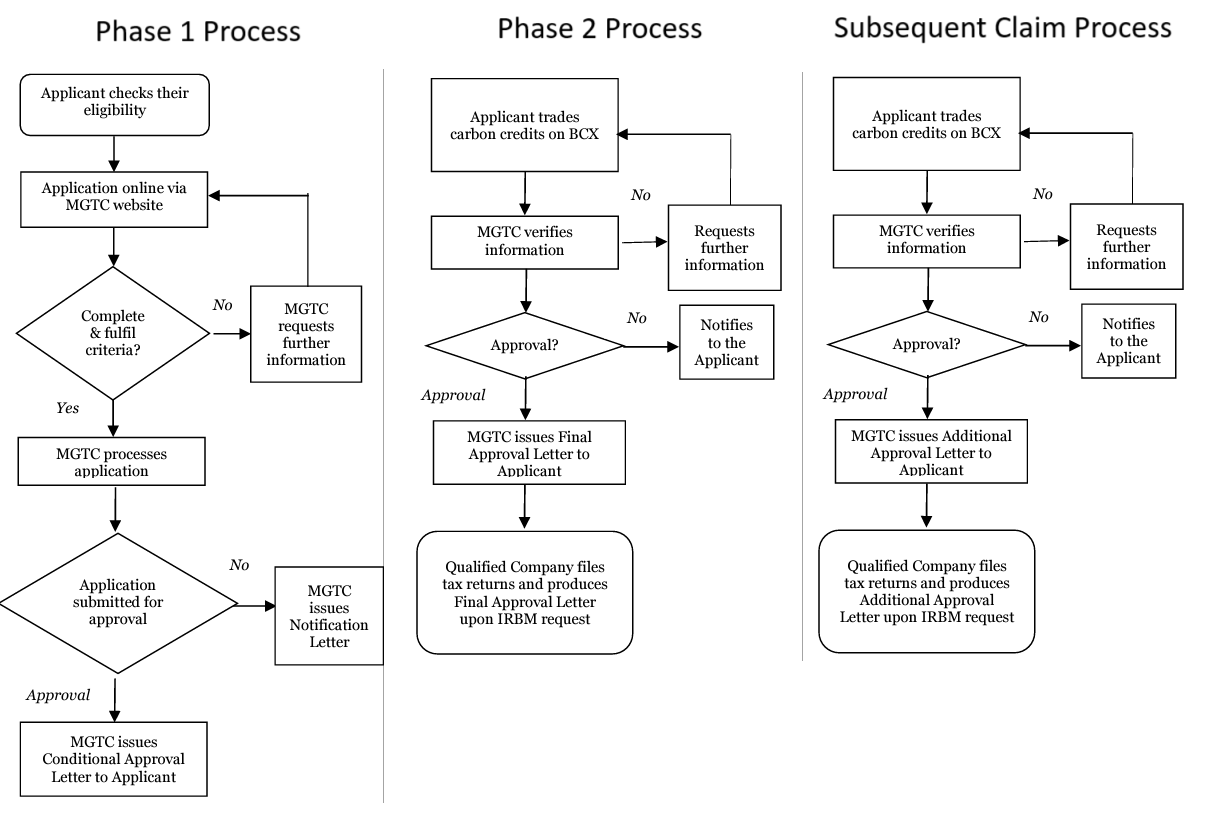

Further tax deduction of up to RM300,000 will be granted to companies that incur expenses on MRV and activities related to the development of Carbon Projects. This incentive is applicable to companies that submit applications to Malaysian Green Technology and Climate Change Corporation (MGTC) from 1 January 2024 to 31 December 2026. The further tax deduction is deductible from the carbon credit income derived from trading at the BCX.

The objectives of the tax incentive are:

a) To incentivise local Project Proponents to undertake necessary processes involved in the development of Carbon Projects in Malaysia;

b) To support local Projects Proponents to overcome financial barriers in developing Carbon Projects in Malaysia; and

c) To grow Voluntary Carbon Market ecosystem in Malaysia by creating an enabling investment environment for local project developers.